Avoiding costly mistakes in your home-buying journey is essential, especially with so much at stake. Here’s a quick look at the most common mistakes buyers are making in today’s Greater Cincinnati, Northern Kentucky, and Southeast Indiana markets—and how an experienced agent can help you sidestep each one.

**Trying to Time the Market**

In hopes of getting the best deal, some buyers wait for home prices or mortgage rates to drop, aiming to time the market. This strategy can be risky due to unpredictable factors influencing the housing market. Elijah de la Campa, Senior Economist at Redfin, advises:

> “My advice for buyers is don’t try to time the market. There are a lot of swing factors, like the upcoming jobs report and the presidential election, that could cause the housing market to take unexpected twists and turns. If you find a house you love and can afford to buy it, now’s not a bad time.”

A knowledgeable real estate agent can guide you through this uncertainty, helping you focus on what matters most for your home-buying goals.

**Buying More House Than You Can Afford**

It’s easy to feel tempted to stretch your budget, but buying a home should align with your financial comfort. Rising costs like property taxes and insurance mean it’s important not to overextend. Bankrate offers wise advice:

> “Focus on what monthly payment you can afford rather than fixating on the maximum loan amount you qualify for. Just because you can qualify for a $300,000 loan doesn’t mean you can comfortably handle the monthly payments that come with it along with your other financial obligations.”

**Missing Out on Assistance Programs**

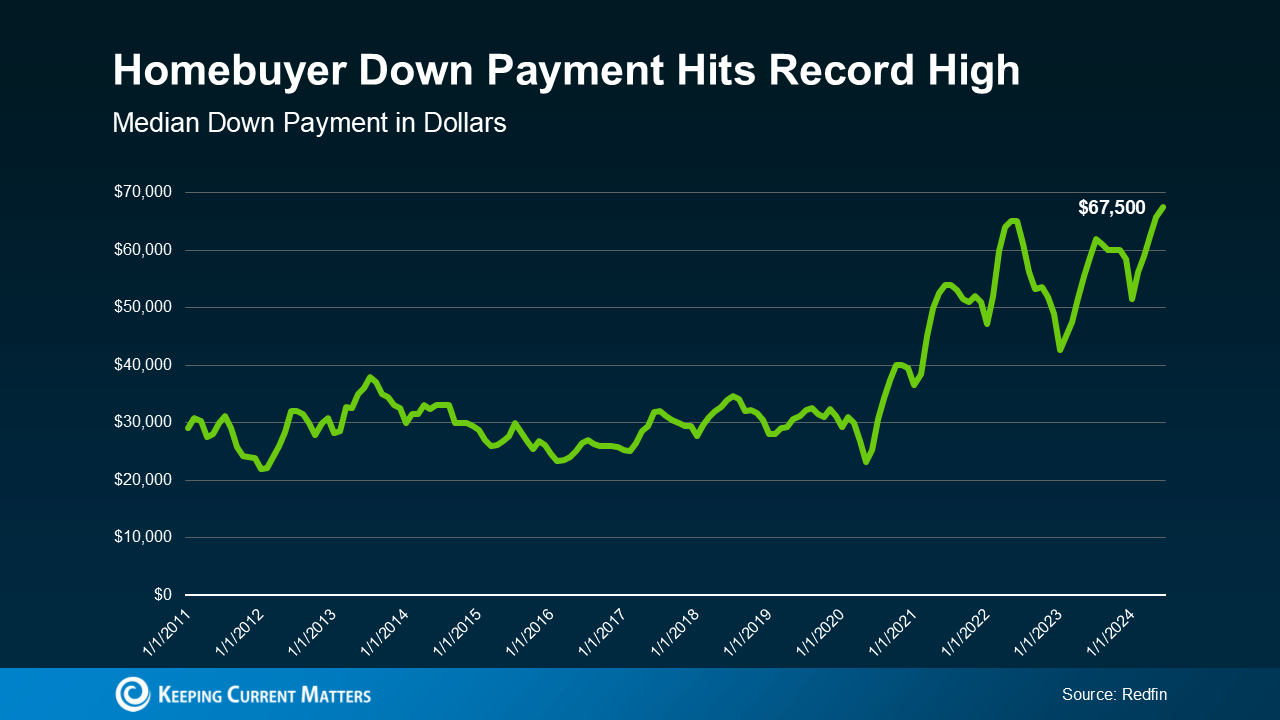

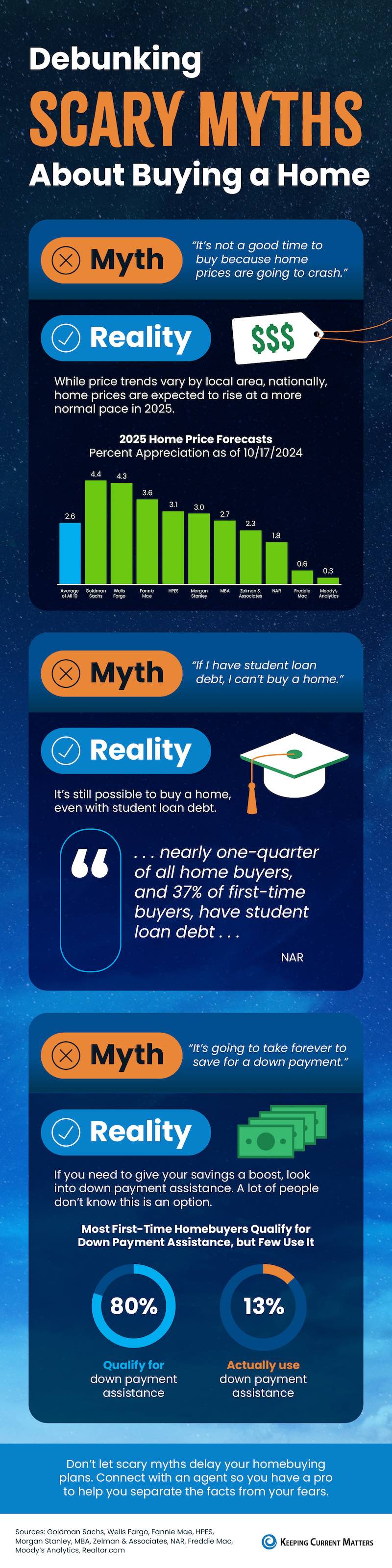

Saving for closing costs, down payments, and other upfront expenses takes planning. Many buyers overlook assistance programs that could help ease these costs, especially first-time buyers. Realtor.com highlights that nearly 80% of first-time buyers qualify for down payment assistance, but only 13% take advantage of these opportunities. Consult a lender and your agent to explore available programs.

**Not Leaning on Expert Guidance**

This may be the most important point of all. Working with a seasoned real estate agent helps you avoid pitfalls and make confident, informed decisions as you explore homes for sale in Greater Cincinnati, Northern Kentucky, or Southeast Indiana.

**Bottom Line**

With the right real estate agent, you’ll have a pro on your side to help you avoid costly mistakes and make your home-buying journey as smooth as possible. Whether you’re looking to buy or sell a house, connecting with a trusted real estate expert in your area will help you navigate each step with confidence.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Planning To Sell Your House in 2025? Start Prepping Now

Planning To Sell Your House in 2025? Start Prepping Now