Did you know? Many homeowners in the Cincinnati and Northern Kentucky real estate markets are finding they can make larger down payments when purchasing their next home. This is because, after selling their current home, they can leverage the equity they’ve built up toward a substantial down payment on a new property. As home equity continues to grow in Cincinnati, Northern Kentucky, and across the U.S., the median down payment is hitting new records.

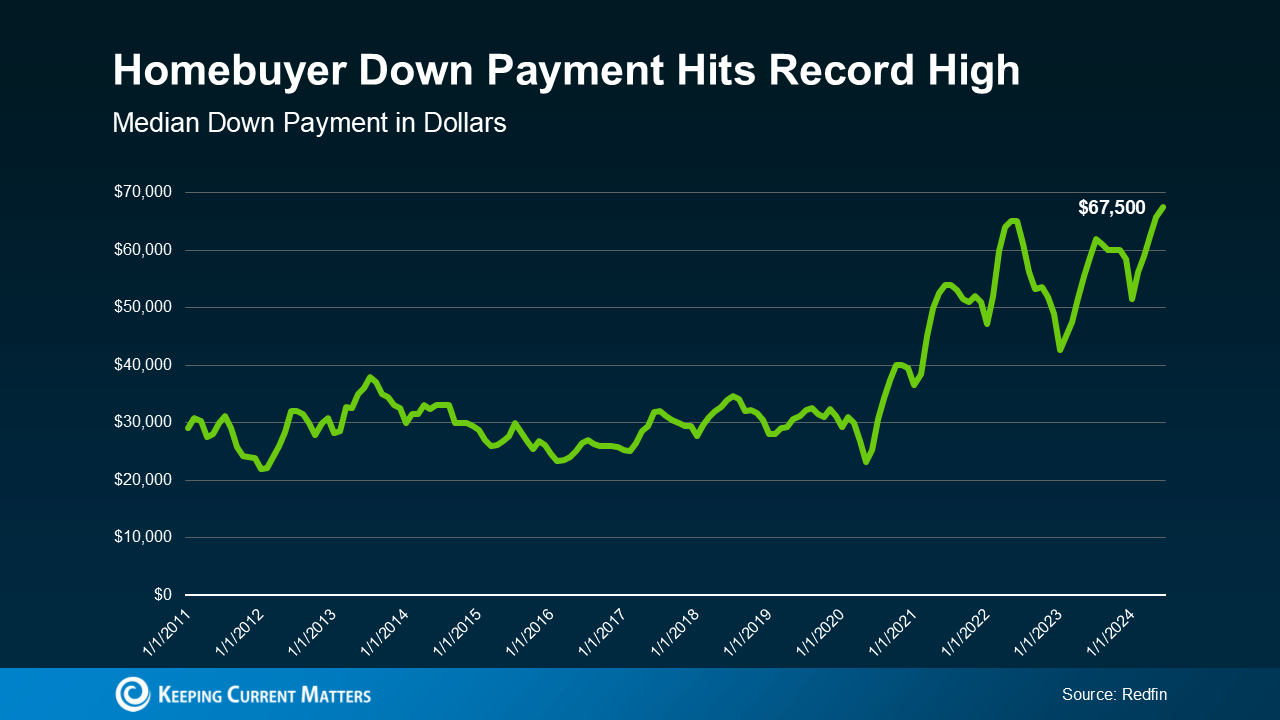

According to Redfin’s latest data, the typical down payment for U.S. homebuyers is $67,500, an increase of nearly 15% from last year and the highest on record (see graph below):

*Graph displaying the increase in home equity and down payments.*

Here’s how home equity helps. Over the past five years, the Cincinnati and Northern Kentucky housing markets, like many others, have seen significant increases in home values. This means homeowners have gained substantial equity, which can be used as a powerful tool when purchasing their next home. This equity can provide you with the opportunity to make a larger down payment, which can be especially beneficial if you’ve had concerns about home affordability.

It’s worth noting that you don’t always need a large down payment to buy a home. There are loan programs available in the Cincinnati and Northern Kentucky areas that allow buyers to put down as little as 3%, or even 0%. However, many current homeowners are opting for bigger down payments because of the significant advantages.

### Why a Bigger Down Payment Can Be a Game Changer in Cincinnati and Northern Kentucky

**1. You’ll Borrow Less and Save More in the Long Run**

By using your equity to make a larger down payment on your next home, you’ll borrow less. And the less you borrow, the less interest you’ll pay over the life of your loan. This means substantial long-term savings, leaving you with more money in your pocket.

**2. You Could Secure a Lower Mortgage Rate**

A larger down payment signals to lenders that you’re financially stable and a lower credit risk. This often results in securing a lower mortgage rate, helping you save even more over time—an important factor when purchasing in competitive markets like Cincinnati or Northern Kentucky.

**3. Your Monthly Payments Could Be Lower**

A bigger down payment reduces the amount you need to borrow, which in turn lowers your monthly mortgage payments. This can make your next home more affordable, giving you more flexibility in your budget and helping you manage living expenses in areas like Cincinnati and Northern Kentucky.

**4. You Can Avoid Private Mortgage Insurance (PMI)**

If you’re able to put down 20% or more, you can skip PMI, which is a cost many buyers must pay if they make a smaller down payment. Freddie Mac explains PMI as:

“For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It is not the same thing as homeowner’s insurance. It’s a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment less than 20%.”

Avoiding PMI can significantly reduce your monthly housing costs, leaving you with more financial freedom in your new home.

### Bottom Line for Cincinnati and Northern Kentucky Homeowners

Down payments are at record highs, largely due to rising home equity. If you’re considering selling your home and purchasing a new one in Cincinnati or Northern Kentucky, this is an excellent time to use that equity to your advantage.

Reach out to a trusted local real estate agent to determine how much equity you have and how it can enhance your buying power in today’s competitive market. A professional familiar with the Cincinnati and Northern Kentucky real estate landscape can guide you through the process and help you make the most of your opportunities.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link