**Navigating Rising Mortgage Rates: What You Need to Know**

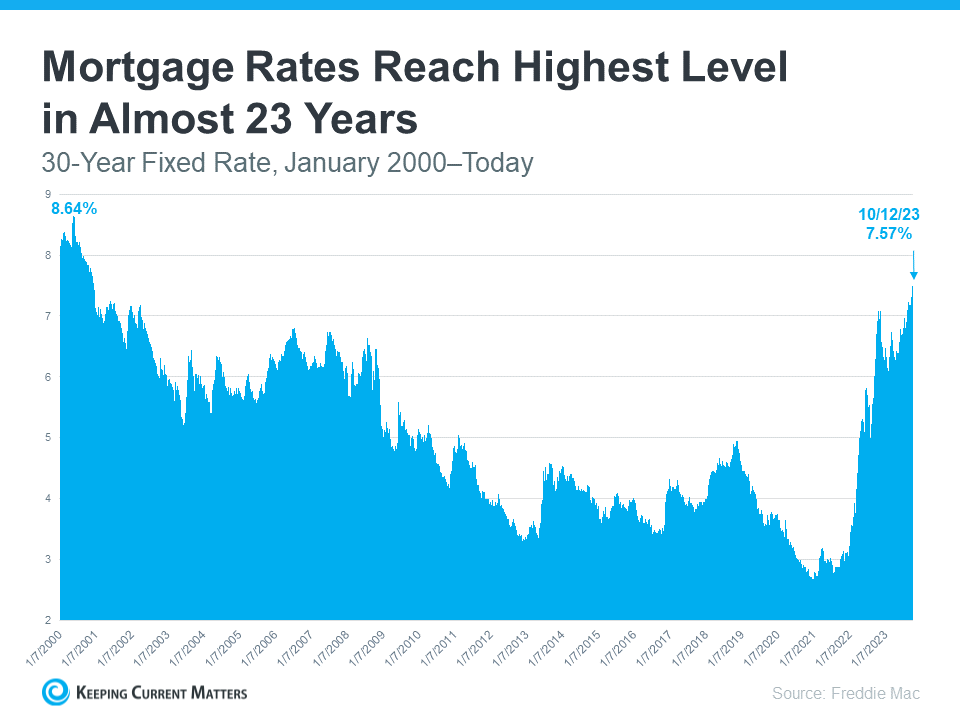

Mortgage rates have been making waves in recent headlines, and if you’re in the market for a new home or considering a real estate move, you might have felt a pang of anxiety. The chatter in financial circles suggests that rates have recently reached their highest point in over two decades. But before you put your plans on hold or dive into a guessing game about the future of mortgage rates, let’s unpack the situation and explore what you really need to know.

### **How Higher Mortgage Rates Impact You**

First things first, it’s undeniable that mortgage rates are higher now than they’ve been in recent years. When rates are up, they can significantly affect the overall affordability of homes. The mechanism behind this is rather straightforward: the higher the interest rate, the more expensive it becomes to borrow money for purchasing a home. As rates trend upwards, your monthly mortgage payments for your future home loan also increase.

The Urban Institute has shed light on the impact of rising mortgage rates on both buyers and sellers:

“When mortgage rates go up, monthly housing payments on new purchases also increase. For potential buyers, increased monthly payments can reduce the share of available affordable homes . . . Additionally, higher interest rates mean fewer homes on the market, as existing homeowners have an incentive to hold on to their home to keep their low interest rate.”

In essence, the rising rates are causing some prospective buyers to reconsider their plans. But the real question is, should you follow suit?

### **Where Will Mortgage Rates Go from Here?**

If you’ve been keeping your fingers crossed for mortgage rates to drop, you’re not alone. Many are eagerly awaiting that dip. However, here’s the catch: no one can predict when it will happen. Even financial experts find themselves in a bit of a guessing game when it comes to forecasting the future of mortgage rates.

While forecasts might suggest a decline in rates in the months ahead, recent data indicates a climbing trend. This discrepancy highlights the unpredictability of mortgage rates. Therefore, trying to time the market or predict future rates is a risky strategy, as CBS News rightly advises:

“If you’re in the market for a new home, experts typically recommend focusing your search on the right home purchase — not the interest rate environment.”

Instead of trying to control the uncontrollable, your focus should shift to assembling a team of skilled professionals who can provide insights into the market and guide you through these uncertain times. Whether you’re moving due to a job change, wanting to be closer to family, or experiencing other life changes, a knowledgeable lender and real estate agent can help you navigate the complex landscape.

### **Bottom Line**

The best advice for anyone considering a move in the current mortgage rate environment is simple: don’t attempt to control what you can’t predict – especially mortgage rates. Even the experts find it challenging to provide concrete forecasts for where rates are headed. Instead, channel your energy into building a team of trusted professionals who can keep you well-informed throughout your home-buying journey. When you’re ready to embark on the process, reach out to a local real estate agent who can offer the expertise and guidance you need.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link